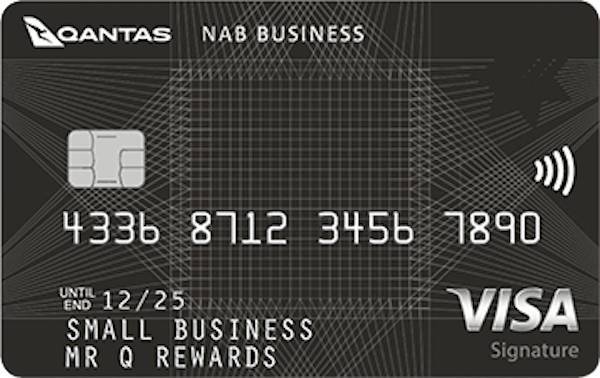

Are you a small business owner looking to maximize your Qantas Points earning potential? The NAB Qantas Business Signature Credit Card could be the perfect solution for you. With up to 200,000 bonus Qantas Points on offer and a range of business-friendly features, this card is designed to help you earn points on your everyday business expenses. In this article, we’ll explore why the NAB Qantas Business Signature Card is worth considering and guide you through the application process.

Why Should I Get a NAB Qantas Business Signature Credit Card?

The NAB Qantas Business Signature Card offers a range of benefits that can help you earn and redeem Qantas Points more efficiently. Here are some key reasons to consider this card:

Earn Bonus Qantas Points

New cardholders can earn up to 200,000 bonus Qantas Points when they spend $4,000 on eligible purchases within the first 60 days of account opening. This generous offer can help you reach your reward goals faster.

Earn Points on Government Payments

You’ll earn Qantas Points at the same rate as everyday business purchases when you make eligible government payments using your card.

Manage Your Cards Easily

The NAB Qantas Business Signature Card allows you to attach multiple cards to a single facility, set individual credit limits, and receive detailed monthly statements for each cardholder.

Complimentary Insurances

The card comes with complimentary Unauthorised Transaction Insurance and Transit Accident Insurance, providing valuable protection for your business.

Global Concierge Service

Access a 24/7 concierge service for assistance with travel planning, event bookings, and other lifestyle services.

Security and Fraud Protection

NAB takes fraud protection seriously, offering security features like NAB Defence to protect your business credit card against fraudulent activities.

Pros and Cons of NAB Qantas Business Signature Credit Card

| Pros | Cons |

|---|---|

| Up to 200,000 bonus Qantas Points | $295 annual fee |

| Earn points on government payments | 3% overseas transaction fee |

| Manage multiple cards under one facility | Points capped at $50,000 per card per statement period |

| Complimentary insurances | – |

| Global concierge service | – |

| Security and fraud protection | – |

Fees and Interest Associated with NAB Qantas Business Signature Credit Card

| Fee | Amount |

|---|---|

| Annual fee | $295 |

| Balance transfer fee | 3% of the transferred amount |

| Overseas transaction fee | 3% of the converted amount |

| Cash advance fee | 3% of the cash advance amount or $3.75, whichever is greater |

| Late payment fee | $15 |

| Over-limit fee | $15 |

How to Apply for a NAB Qantas Business Signature Credit Card?

To apply for the NAB Qantas Business Signature Card, follow these steps:

- Visit the NAB website and navigate to the Qantas Business Signature Card page.

- Click on the “Apply Now” button.

- Fill out the online application form with your business and financial information.

- Submit the application and wait for a decision.

Eligibility Criteria

To be eligible for the NAB Qantas Business Signature Card, your business must:

- Have an annual turnover of at least $75,000

- Operate a trading ABN or ACN

- Have at least 12 months of business financial data

The Final Words

The NAB Qantas Business Signature Card is valuable for small businesses earning Qantas Points on everyday expenses. It offers generous bonus points and competitive earning rates. The card includes business-friendly features that streamline spending. This helps you reach your reward goals faster. If eligible and comfortable with fees, consider applying today.

Alright guys, just checked out taib29bet – pretty smooth! Easy to navigate, good selection of games. Worth a look, definitely. You can check it out here: taib29bet

Seriously digging the bet979app. Super user-friendly, and I can easily track my bets while I’m out and about. Big fan! Download it here: bet979app